An Insight into the Nikkei 225 Index

poellauer-news >> Finance>> An Insight into the Nikkei 225 Index

An Insight into the Nikkei 225 Index

Introduction

The Nikkei 225, often referred to simply as the Nikkei, is Japan’s most prominent stock market index. Tracking the performance of 225 large, publicly-owned companies in the Tokyo Stock Exchange, it is a vital indicator of Japan’s economic health and investor sentiment. As the third-largest economy in the world, fluctuations in the Nikkei can have significant implications not just for Japan, but for global markets as well. Understanding the trends and movements within the Nikkei 225 is essential for investors and economic analysts alike, especially in today’s constantly shifting financial climate.

Current Performance

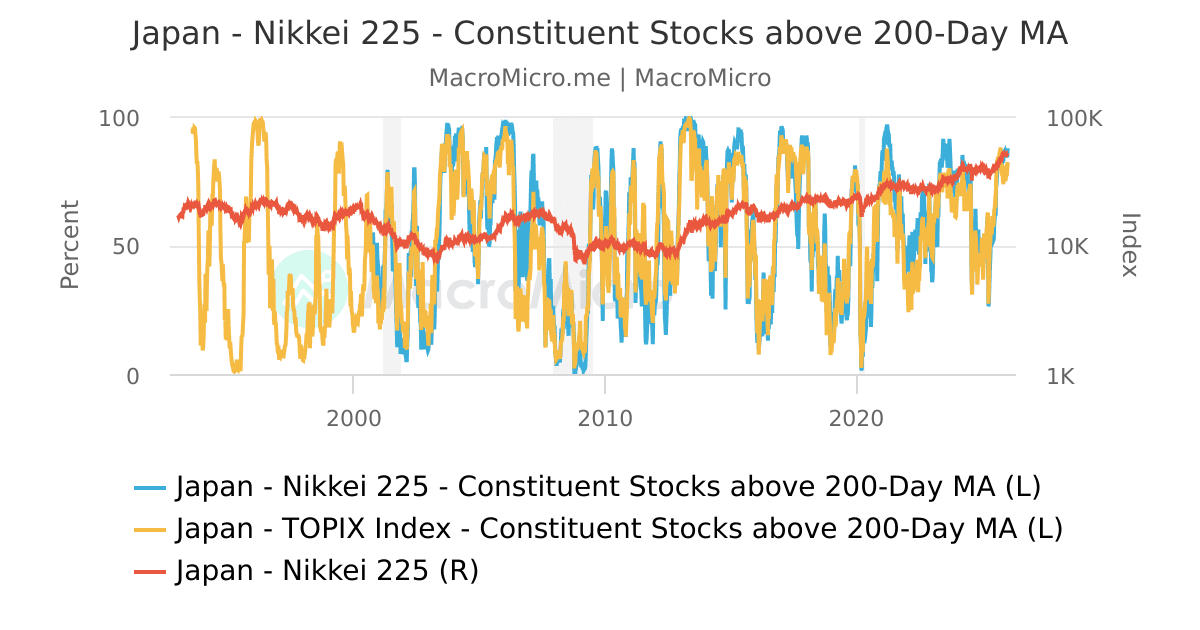

As of October 2023, the Nikkei 225 has shown a remarkable recovery, climbing approximately 20% year-to-date. This upward trend can be attributed to several factors, including strong corporate earnings reported by major Japanese companies and a weaker yen bolstering export competitiveness. Notable firms within the index, such as Toyota and Sony, have posted robust financial results, pushing the index higher and reflecting bullish market sentiment.

Impact of Global Events

The international economic landscape significantly influences the Nikkei 225. Factors such as changes in interest rates by the US Federal Reserve, trade tensions, and geopolitical tensions in Asia can lead to volatility in the index. In recent months, the ongoing adjustments in China’s economic policy regarding its real estate sector have also impacted investor confidence in the regional economy, exerting added pressure on the Nikkei. Observers note that continued consumer sentiment in both Japan and abroad remains crucial for sustained growth.

Outlook and Conclusion

Looking ahead, analysts are cautiously optimistic about the Nikkei 225. While the index has rebounded strongly, concerns over inflation and potential tightening of monetary policy could pose challenges in the near term. Furthermore, the ongoing inefficiencies in the labor market and the need for structural reforms in Japan’s economy remain areas of concern that could influence the index’s trajectory.

In conclusion, the Nikkei 225 not only serves as a barometer for the Japanese stock market but also offers invaluable insights into broader economic trends affecting global markets. For investors and stakeholders, keeping a close eye on this index will be essential as it navigates through evolving domestic and global economic conditions.